Most retail investors avoid direct contact with commodities and bond markets, since these tend to be high-risk classes. Cash and Equivalents – Money in a bank account or other secure assets that you can liquidate immediately.Contracts – Instruments issued by private parties such as certificates of deposit and annuities.Commodities – Ownership of goods or products, typically raw resources, which trade based on their future prices.Stocks – Shares of ownership issued by private companies, which typically break out into large, mid, and small-cap categories according to the size of the issuing firm.Income-Generating Bonds – This is a sub-set of bonds that pay interest on a regular basis.Bonds – Debt instruments issued by governments and large organizations.Some of the popular asset classes include: Ideally, spreading your investments across a variety of asset classes allows you to take advantage of different systematic risks.

Conversely, commodities and bonds rise when stocks fall. For example, when the stock market does well, commodities and bonds tend to do poorly. Critically, different asset classes have different ‘ systemic risk‘, which describes how they respond to the market at large.

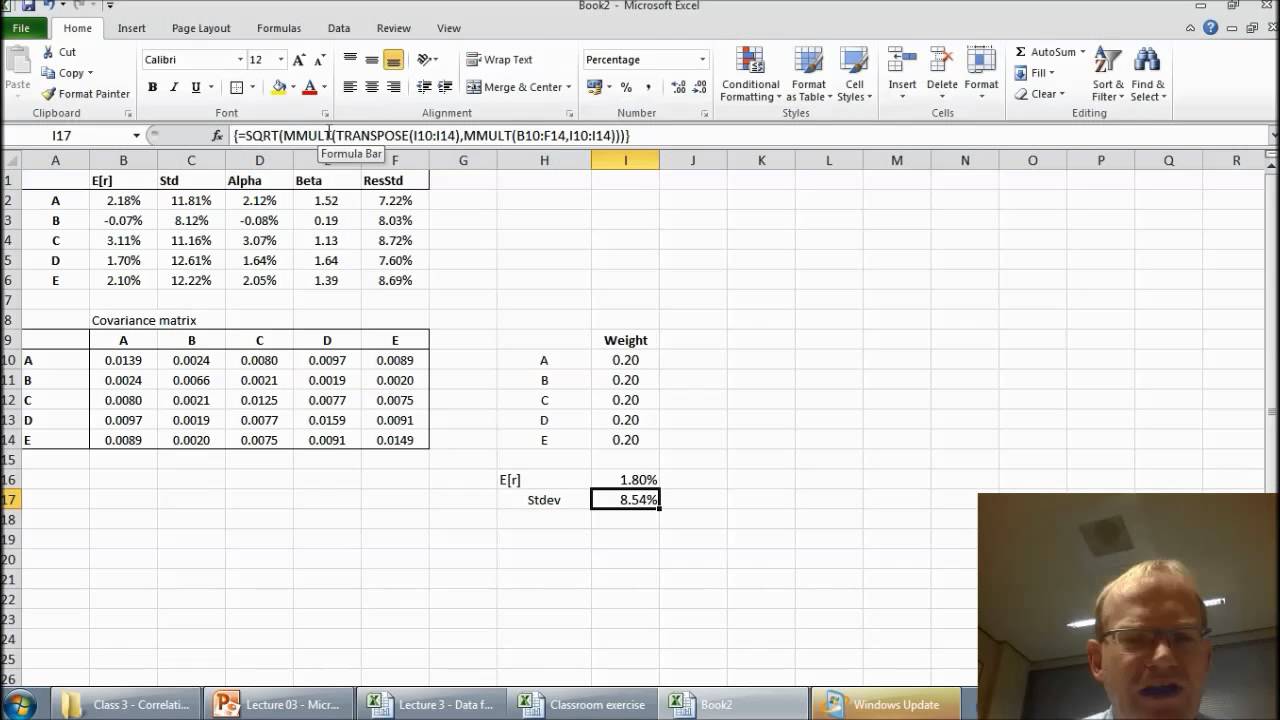

Furthermore, every asset has a distinct return and risk profile. Financial asset classes include different types of securities, debt and equities that you can hold. (Alternatively, this term may refer to a portfolio that has the minimum amount of risk for the return that it seeks, although it’s a less common usage.) Asset Classes and OptimizationĪny portfolio optimization strategy will apply the concept of diversification, which means investing in a wide variety of asset types and classes.ĭiversification across asset classes is a risk-mitigation strategy.

This means it’s generating the highest possible return at your established risk tolerance. Portfolio optimization should result in what investors call an ‘efficient portfolio’. Then, you’ll balance those assets in order to attain your desired risk-reward outcome. This means creating a balanced portfolio, which means want to spread your investment capital across a variety of assets.

0 kommentar(er)

0 kommentar(er)